When it comes to making investment choices, we are led to believe that nothing is more solid than bricks and mortar – it’s where the expression ‘safe as houses’ comes from. But what if the property in question isn’t quite as solid as it should be? Any mention of structural movement or subsidence when you’re trying to sell your home will ring alarm bells with buyers, many of whom will run a mile at the very thought of a house with potentially compromised foundations.

As a property seller, this leaves you in a delicate situation. However, the fact is that if your home has suffered from subsidence in the past, no matter how long ago or how minor the event may have been, and even if the property has been subsidence free for over a decade, you won’t be able to ignore the problem when the house goes on the market.

It’s only a matter of time before a buyer’s home survey will flag up subsidence, and not disclosing the issue at the outset can quickly lose you the goodwill of a buyer. Our professional advice is to have an effective strategy in place to deal with buyer queries and maximise the chances of getting your property sold.

The term subsidence refers to a structural movement that occurs when the ground on which the building stands begins to sink. The physical shift on unstable soil can affect the foundations. As one side sinks, the integrity of the building may become compromised. Ultimately, the structure may be at risk of collapse.

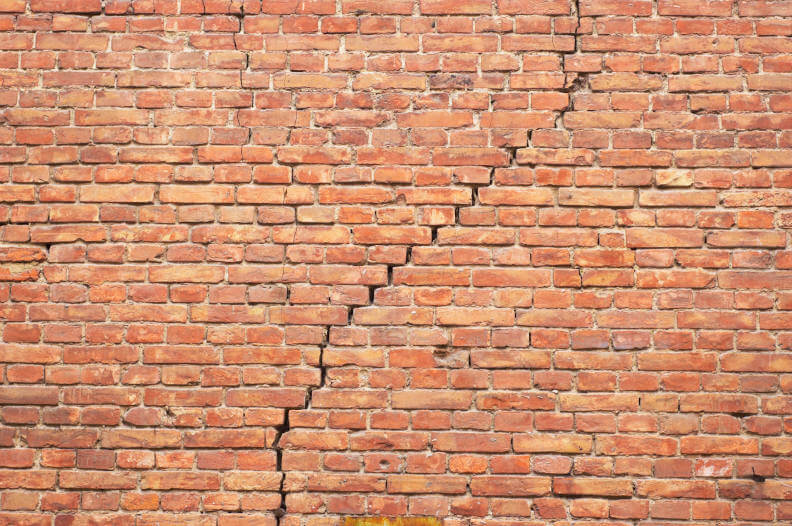

One of the first signs of subsidence is cracks in the wall that appear suddenly, especially around doors and windows. These tend to be wider at the top than at the bottom and often follow a diagonal pattern, causing openings to be out of alignment. Doors and windows may be sticky and not open or close properly. Subsidence cracks are typically thicker than 3mm and will be visible from both inside and outside the property.

There are many factors that contribute to a property being at risk from subsidence, the main ones being:

Once you have found a buyer who is happy to take a pragmatic approach towards the problem, he will want to investigate thoroughly with the help of a structural Building Survey (Level 3). In any event, any experienced surveyor will be able to spot signs of subsidence and will recommend further investigation. A Specific Structural Inspection can be carried out to identify the extent and urgency of the problem and suggest remedial action.

If subsidence is ongoing, a structural engineer’s report will also provide the buyer with details of cost estimates for monitoring, underpinning and redecorating work as required. You may well need to prepare yourself for a request for a price reduction to take account of the additional expense.

If the subsidence is historic, you will need to provide evidence of past insurance claims and specifications of work to show how the problem was resolved at the time. The buyer may also ask for a Certificate of Structural Adequacy.

Make you are completely honest and cooperative when communicating with your buyer, disclosing all salient facts. It is also a good idea to have all the necessary documentation available to reassure your buyer that their investment will be safe.

Selling a property with a history of subsidence is clearly going to involve more effort than an untroubled house. However, there is no reason it can’t be done, provided you invest some effort and determination into the process.

Resign yourself to the fact that your target market will be smaller, as your property simply won’t appeal to the most cautious homebuyer segment.

Recognise the fact that it will be more difficult for your buyer to get a mortgage for a property with a history of subsidence. There are niche lenders who specialise in hard-to-mortgage properties, but there are also some mainstream mortgage companies who will accept properties that have been subsidence free for 10+ years. It goes without saying that if you are selling a home with ongoing subsidence problems, your target market will be limited to cash buyers only.

Anticipate buyer queries regarding home insurance. Many regular home insurance companies won’t cover properties that have been underpinned or have any history of subsidence, and if they do, premiums are likely to be substantially higher than average. It’s worth doing some homework so you can offer helpful suggestions to your buyer.

Finally, don’t forget to promote your property’s good points! Subsidence issues notwithstanding, you should direct your energies into presenting your property in the best possible light and maximise every opportunity to sing its praises. That way, it will only be a matter of time until a serious buyer is found and the transaction concluded.