‘Searches’ or ‘property searches’ are completed by your solicitor. They work with the local authority (and other organisations) as part of the home-buying process. They use these to find out any information about the property. As well as any local development plans that may affect the home you plan to purchase. 9 of the main […]

Read MoreWell generally the two most obvious are the deposit and the monthly mortgage repayment. Some mortgage provided are starting to lend up to 95% of the property value but deposits can vary between 5-20%. After you have this part figured out in your budget, what else do you need to think about when buying a […]

Read More

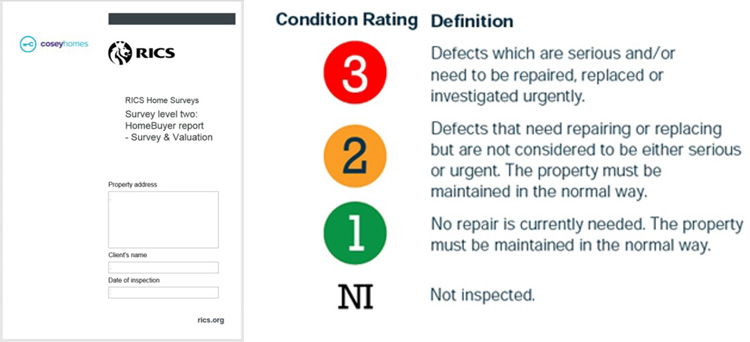

The RICS HomeBuyers report is a visual survey designed to give an overall opinion on the condition of a property. The report runs through the condition of each area of the property and will point out any visible defects. These will be marked using the RICS 321 traffic light system to identify the urgency of […]

Read MoreA HomeBuyer Report is a survey inspection of a property. It will help you find out if there are any structural problems, such as subsidence or damp, as well as any other unwelcome hidden issues inside and outside the property you wish to buy. A RICS HomeBuyer Report means that a chartered surveyor who is […]

Read MoreThe general definition of a first-time buyer is a person buying a house or a flat who has never owned one before and has no property to sell. Basically, you aren’t a homeowner, an investor or simply mortgaging or re-mortgaging an existing home. This seems pretty obvious, so why is everybody talking about whether they […]

Read MoreHere are four of the most important reasons why getting a survey should be high on your priority list when buying a home. 1. A mortgage provider’s valuation is not for your benefit Many people don’t realise that when their mortgage provider says they are going to do a ‘valuation’ of the property, they mean […]

Read More

We’ve added two new “Frequently Asked Questions” sections to our website, one for our survey customers and one for vendors who are selling their property and would like to know a bit more about what happens when a potential buyer commissions a survey. Click here to read FAQs – Purchasers Click here to read FAQs […]

Read More